5 Financial Advisor Branding Tips You Can Implement Today

5 Financial Advisor Branding Tips You Can Implement Today

By Jordan Collins

Tucker Advisors Senior Digital Marketing Specialist

Table of Contents

Click the links below to jump to a client appreciation event page section specific to your needs.

Everyday there are new online tools created and marketed to businesses claiming to drive more leads and grow your prospects. With such a crowded marketplace it is hard to know what tools are necessary and what tools just aren’t the right fit.

For financial advisors, it is important to use mechanisms that allow you more time to meet with clients and write business. At Tucker Advisors, we believe in marginal gains. It’s not about finding a silver bullet that doesn’t exist. It’s about making daily improvements that will make an impact over time to provide consistent value to you and your clients. That’s why we’ve put together 5 ideas for you to implement today!

Create a Professional Email Signature

What is an email signature?

An email signature is a content section at the end of your emails that will be added to each email you send. Below is an example of an email signature:

Many people will use email signatures to include contact information, links, images, and text. With each email that you send, you are also sending your contact info and web properties. It’s up to you to decide what information you’d like people to access in your signature, including your social media sites, phone number, and website address.

The Importance of the signature

Signatures can create extra traffic to your calendar invites, website, and touchpoints in a convenient environment for contacts to access you and your information. If your email is forwarded, those emails will also include your contact information if someone is providing a referral. This is another opportunity to show prospects that you are a polished advisor who is ready to help.

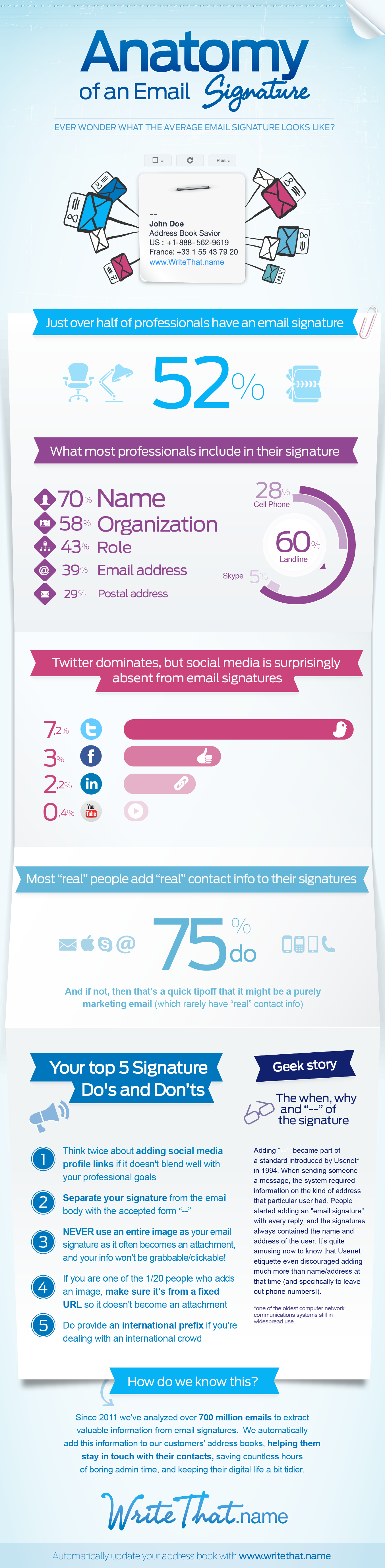

WriteThat.name looked at 700 million emails processed through their contact management solution and found that only 52% of users had email signatures. Here’s the infographic for the study:

What to include in your signature

As you can see, there is a lot you can do with your signature but not all of it will fit what you do for your audience.

Take a minute to think through what pieces would be good for your emails and what wouldn’t. We would highly suggest not making your entire signature an image, as it may be turned to an attachment by some email providers. This will create display issues and not show the information you’d like. It is okay to have text links in your signature, as these will not be changed by email service providers. Convenience is the primary concern of your signature before optics and layout.

Good email signatures provide pertinent information that will always be easy to display. For starters, including your email address, website, your calendar invite, and a professional photo of yourself should do it.

Lastly, if you are going to include time-sensitive information in your signature, be sure to set a reminder to change your signature when the time is right. You don’t want all of your communications going out with an old date or event attached to an unrelated message. For the most part, you’ll want to stick to evergreen content.

How to Change Your Signature

There are countless email service providers and email clients that people use on a daily basis. To try and simplify this process, we will walk you through a high-level version of the process, then provide links to how you do this process using different services.

- Go to your account settings and find where your signature can be edited

- Input any information, images, and/or links you’d like to share

- Save your signature

- Activate your signature from the options in your account settings

This simplified version of the steps isn’t explicit or platform-specific but it’s enough to get you started. For more information on how to change your signature, see the links below for specifics.

If written instructions aren’t your preference, see YouTube for extensive, step-by-step instructions.

Connect Your Offline Materials to Your Online Presence

Business cards date all the way back to the 17th century in Europe. Even our forefathers knew that leaving your information with someone would be a helpful communication tool. The business card has gone through a great number of iterations since then but the conventional wisdom remains. If you want someone to get in contact with you, make it easy!

Whether you have a stack of business cards or a full print package, your materials should take your prospect to where you want them, your point of sale. For many advisors, getting someone from your business card to your appointment calendar is crucial. This is where your marketing spend can make your life easier.

When you create your print materials, be sure to include your website, your email address, and any other important online information that will help your prospects.

Pro Tip: Use evergreen content! Don’t use an email address or calendar link that won’t be the same in 6 months. If you don’t want it going directly to your inbox, create an inbox like “admin@yourretirementspecialist.com.”

When you create new materials or print something, you should always think about who your audience is and what contact information should be included. If it is a current client, linking to your website and including contact information is a must. If you’re talking with a prospect you’ll definitely want to include a way for them to make an appointment and your contact information.

Another way that you can take people directly to a webpage is to include a QR code. A QR code will take a user from their phones’ camera directly to the webpage the QR code is associated with. This is something you can easily print on a paper, guide, or other physical material that can take people to your online presence.

All in all, you want a prospect or client’s offline and online experience to be seamless and easy to use. This will encourage them to refer others and access information with ease.

Professionalize Your Email Address with Your Domain

Why you should customize your email address

At one point or another, you’ve probably sent professional email through a personal email account. There’s nothing wrong with this but there are drawbacks. Email scams and automation have made it difficult to find out what information is important and what isn’t. Email service providers have become more and more astute about filtering these messages, but they don’t always get it right. One way to stick out from the crowd is to professionalize your email address with your domain. Instead of your email address being @gmail.com or @yahoo.com, it would come from your website.

Example: financialadvisors@TGIFinancial.com

Seeing a custom domain in an email address provides context for where the email is coming from and why they are reaching out. The email address lets you know that the person reaching out is from TGI Financial and they are a business before you open the message. When you receive an email from fred9382@gmail.com, there’s no telling whether it is spam, a scam, or an old buddy from high school.

Skip the guessing game and inspire trust in your messages by using a professional email address. You are more likely to get professional responses and signal to users that you are open for business.

How to get a custom email address

If you don’t already own a domain name for your business, you’ll need to start here. Choosing the right domain name for your business is important for a number of reasons but this article should give you a brief overview on how to do it. Once you have your domain name, your domain host will have options for you to create mailing addresses. This process differs depending on who you choose as your domain host, so we will list the processes with links below:

There are more domain hosts out there but most of these processes will have the same steps with slightly different steps. If your personal email address has a lot of business inquiries coming in, we would suggest forwarding those messages to your new address and updating your online presence to reflect this email address for users. This way, your mail is still all in one place.

Once you have an administrator or staff members, be sure to add them to your custom domain email addresses. Be sure to create at least one email account that is not dedicated to a specific person’s name, as this will be a good email address for your website’s contact forms and general inquiries.

Once you have created custom email addresses with your host, test that each email address is working by sending test messages. If you run into issues, follow up with your domain host support for more information.

Create a Website Contact Form

It’s great to have prospects visit your website but it’s better for them to leave you a message. In the modern era, the answering machine has been replaced by the website contact form. The best way for you to capture leads and prospects using your website is by capturing contact information. If your website doesn’t have a place for visitors to give you this information, it’s not going to happen.

To start, add a contact form to your website’s contact or homepage. Your homepage will receive the most traffic of any pages, so this is an important place to include a contact form near the bottom of the page. You can also link buttons on the homepage to take people to the contact form. The contact form doesn’t need to be front and center on your homepage, but it should be available should your visitor choose to get in touch.

Once you’ve edited the page to add a contact form, you’ll want to fill out all of the details of what is mandatory and optional for your form.

Pro Tip: Don’t require a phone number on your form. Studies have found that this one field can impact conversions by up to 47% and many people will not give their real number if you do.

The next step is to test your form. Depending on the contact form or plugin you choose, you’ll need to configure and test that if someone fills out the form, it does show up in your inbox. For this reason, some will use a plugin while others will only need to fill out the contact box in your page builder.

Contact forms are crucial to your online success because they are a window for prospects to turn into a lead. Your website could have the best presentation of your business possible, but without a simple way for them to reach out, it can only produce brand awareness. With a contact form, you have the opportunity to create new leads.

Create a Prospect List with Online Tools

Finding viable prospects is one of the hardest jobs for a financial advisor. Companies know this and have entire business models built around selling contact information.

Pro Tip: Most bought lists are not compliant with mass email providers’ terms of service agreements. Sending out messages to a bought list that hasn’t opted-in to receive messages from you can get your Mailchimp, Constant Contact, or other ESP account blacklisted.

With all of these hoops to jump through, you may be thinking “how can I contact new prospects?”

One strategy is to get your library card. Yes, we meant that last line, your library card.

Many libraries have free access to tools outside of just checking out books. Reference Solutions by Data Axle (formerly ReferenceUSA) is the leading source for business and residential data in the United States. Libraries across the United States provide access to information within Reference Solutions at no extra cost if you are a local card holder.

See your local library’s website for information on what data they have access to. This way you are saving on your budget and still have the ability to get reliable data from a quality source.

–

There you have our 5 financial advisor branding tips you can implement today. We hope that these suggestions are helpful in your prospecting and will continue to build your financial advisory practice for the future. For more information on digital marketing, check out our article on how to track direct mail campaigns.

Sources:

www.Blog.gimm.io

If you are looking for more ways to market your financial advisory practice, see this presentation from Tucker Advisors CMO Justin Woodbury.

If you would like more information on digital marketing strategy, visit here.

For Financial Professional Use Only. NOT INTENDED FOR VIEWING OR DISTRIBUTION TO THE PUBLIC. Insurance-only agents are not licensed to offer investment advice.

Join Tucker Advisors

Call 720-702-8811 or email COO Jason Lechuga at Jason.Lechuga@TuckerAdvisors.com